What's the most important KPI for your dental practice? What are the numbers and figures you should be tracking to grow your practice and your bottom line? Let's be honest, you didn't get into dentistry to give all that hard work away for free. You're here to build a business, create jobs, and give back to the community. You can't do those things if your business isn't succeeding. At tab32, we've created a dashboard to help you track your KPIs from anywhere you are. Click here to set up a demo to see it yourself.

What's the most important KPI for your dental practice? What are the numbers and figures you should be tracking to grow your practice and your bottom line? Let's be honest, you didn't get into dentistry to give all that hard work away for free. You're here to build a business, create jobs, and give back to the community. You can't do those things if your business isn't succeeding. At tab32, we've created a dashboard to help you track your KPIs from anywhere you are. Click here to set up a demo to see it yourself.

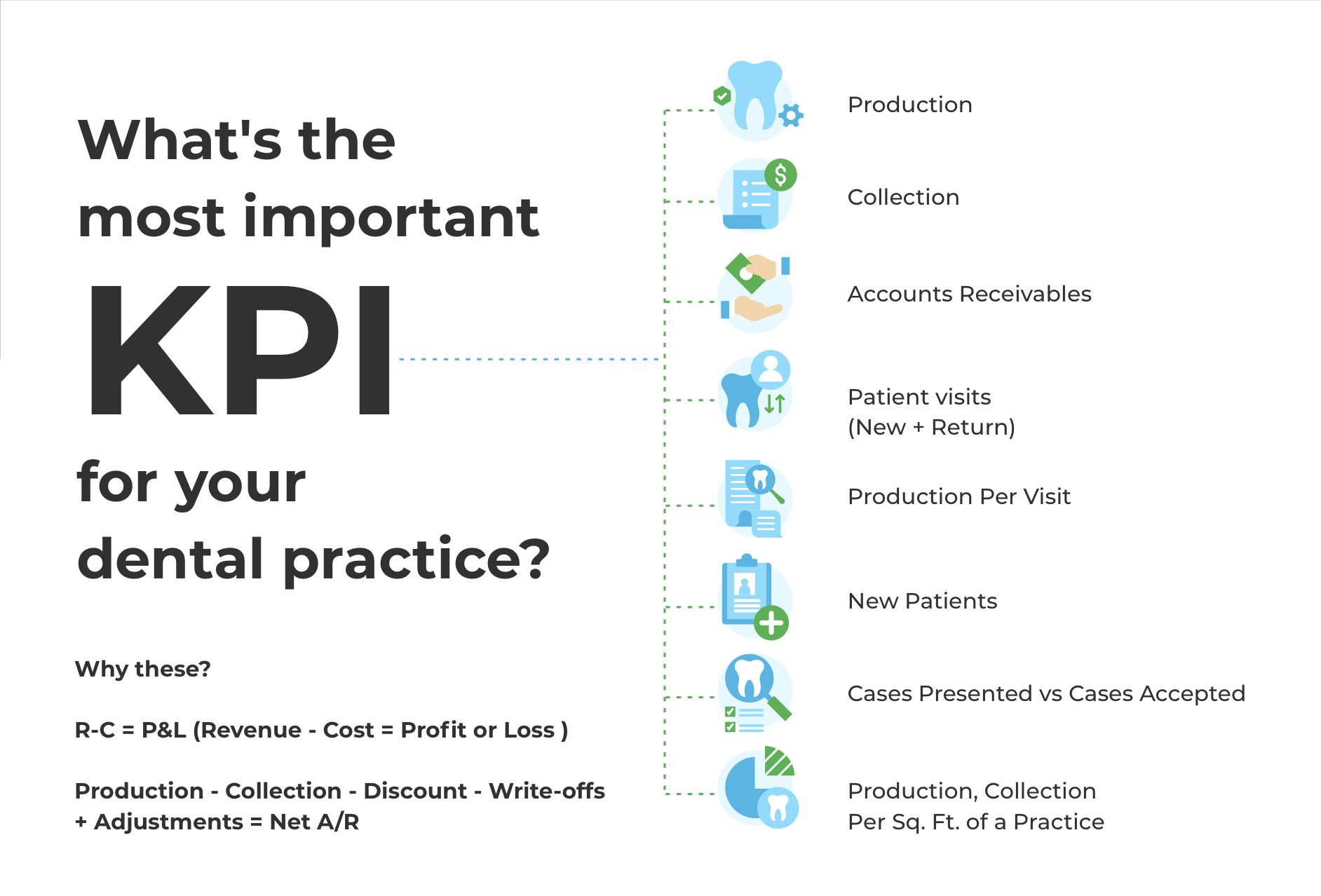

Let's take a look:

These represent the KPIs we've identified as the most important (or key) metrics for you to track. These Key Performance Indicators (KPIs) are available in the form of reports within a practice management system (PMS) or central electronic health record (D-EHR). However, the reports are not always available, depending on the system. Your software may need to be supplemented for reports using additional software like Excel or another statistical tool.

Today's dentist needs to track the growth of his or her practice and take corrective actions in time to stay profitable. However, in our experience, most practices are under-prepared for such a dynamic action plan. Further, the new practice owners—starting new or purchasing an existing practice—must be prepared to track these critical KPI's to plan for gross profit margins and break-even.

Let's get into the details of profit and loss and cash flow accounting.

R-C = P&L (i.e. Revenue (R) minus Cost (C) is equal to Profit or Loss (P&L))

Revenue in relation to Accounts Receivables:

Production - Collection - Discount - Write-offs + Adjustments = Net A/R

Firstly, let's get Cost (C) out of our way, which most of the practices have good command. The fixed cost like office lease, utilities, loan repayments, staff salaries and other overhead, is straightforward and accurately predictable. The variable costs are a small percentage of total revenue due to nature of the business, and easy to predict (e.g. disposable inventory based on the number of patients per month).

Now for simplicity, let's assume that Revenue (R) is equal to Production. In practice, production depends upon contracted fees rather than billed UCR. However, it is easy to track production but understanding the key underlying drivers of the production is critical. These key drivers of production are:

The relationship is quite simple, the number of patient visits—new or

Lastly, tracking the rate of collection and cycle-time of accounts receivable is critical to keep positive cash-flow. To explain these interdependent variables we generally ask how fast a practice can collect either from patient or insurance? Generally, these receivables can take anywhere from 15 to 90+ days to collect. The longer it takes, the higher the strain on cash-flow because a practice is spending money today but collecting later. The patient collection cycle-time can be managed by collecting co-payments during the visit, giving a cash discount for an upfront payment, accepting credit cards, and more.

It is critical to track these key performance indicators (KPIs) for a practice to plan ahead and keep focused on the growth. If you need help with these metrics, tab32 provides an out-of-box intelligent dashboard to track these key metrics and many other drivers with the help of over 50+ graphs. We want to help your practice succeed. Contact us for a free demo and learn how tab32 is the perfect partner for your practice management.

These Stories on Tips for Running a Dental Practice

No Comments Yet

Let us know what you think